MAIN PUBLICATION :

| Home � INDUSTRY & MARKETS � European market overview � Tiered growth led by Germany, Spain, UK, Italy, France |

|

Tiered Growth Led by Germany, Spain, UK, Italy, France

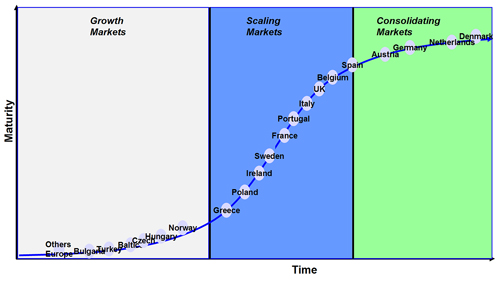

Europe’s onshore wind power sector can be divided into three main market types – consolidating, scaling, and growth markets - reflecting each market’s maturity as a development environment and the intensity of competition within the country.

- Growth markets include those with a nascent wind energy sector, where the gradual creation and implementation of a stable regulatory framework is expected to facilitate sporadic project activation. The total wind power installed in growth markets remains under 1,100 MW, accounting for less than 3 per cent of the region’s total installed power capacity.

- Scaling markets are characterised by strong remaining resources coupled with stable regulatory frameworks that will facilitate project development. As such, these markets will experience high project volume in the near term, and are expected to be Europe’s main driver of growth, accounting for an increasing share of the region’s total installed energy capacity. With large wind resources and market environments propitious to investments in wind, scaling markets are now experiencing an influx of foreign players that is leading to heightened competition for projects.

- Consolidating markets have reached a good level of maturity, have high penetration levels (>10 of national installed generation capacity), and have limited greenfield opportunities available. Denmark and Germany are the archetypal consolidating markets where wind has become a mainstream source of energy and the best sites have already been tapped out. As such, the majority of projects coming online in the next few years have already been fully permitted or are now in the final permitting stages.

Figure 2.10: Wind Power Onshore Market Maturity

Source: Emerging Energy Research

At national level, these market groupings have several implications in terms of the expected number of MW needed to tap remaining potential, as well as the intensity of the competition among players to tap undeveloped sites. Consolidating markets are most likely to turn in relatively flat or declining MW additions in the short term until the markets begin going offshore or facilitating widespread repowering (replacing older turbines). Germany is gearing up for its first offshore project, while Denmark and the Netherlands have already launched theirs.

Scaling markets led by Spain, the UK, Italy, France and Portugal will probably host the bulk of Europe’s onshore growth in the near term. These countries’ wind potential, relatively untapped pool of sites and supportive renewables policies will create the most competitive markets for project permits and asset ownership. These markets will be followed by smaller growing markets in Eastern Europe that still have to develop a steady flow of projects to support the industry.

| Acknowledgements | Sitemap | Partners | Disclaimer | Contact | ||

|

coordinated by  |

supported by  |

The sole responsibility for the content of this webpage lies with the authors. It does not necessarily reflect the opinion of the European Communities. The European Commission is not responsible for any use that maybe made of the information contained therein. |