MAIN PUBLICATION :

| Home � INDUSTRY & MARKETS � Industry actors... � Planned future investment |

|

Planned Future Investment

Capital-intensive construction of large wind capacity pipelines requires major investments by the utilities and IPPs planning to own assets. Sources of equity have taken a turn towards larger-scale, longer-term capital Expenditure plans, with bond issues, IPOs and debt facilities proliferating among the top players. IPOs of utility renewable units have been consistently oversubscribed in equity markets, while the overall volume of funds earmarked for wind capacity is reaching new heights.

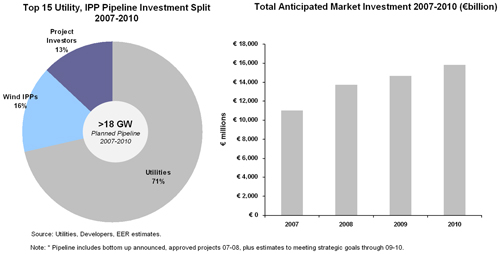

For the 2007 to 2010 time period, Europe’s top 15 utilities and IPPs (in terms of MW owned) declared project pipelines totalling over 18 GW, which translates into well over €25 billion in wind plant investments based on current cost estimates per MW installed. Overall, the European wind market is expected to grow at a rate of over 8-9 GW of annual installations up to 2010, which translates into yearly investments of between €10 billion and €16 billion. There will be several key investment trends in this period:

- Utilities are expecting to move into pole position as the clear leaders in wind capacity construction through three to five year CAPEX investment plans. For some players, these plans are worth over €6 billion and include offshore projects and expansion into Eastern Europe, combined with consolidation of their domestic market positions.

- The financial capacity of vertically integrated IPPs will be tested as they go head-to-head with utilities. These players will reach deeper into the pockets of their parent companies to carry on accumulating assets in their target markets.

- Project buyers, or non-integrated IPPs, are likely to pick off individual turnkey opportunities with smaller investments plans of under €1 billion.

Figure 3.6: European Pipelines, Investments Surging Past €10 billion Annually

Note: * Pipeline includes bottom up announced, approved projects 2007-2008, plus estimates to meeting strategic goals through 2009-2010

Source: Utilities, IPPs, Emerging Energy Research.

| Acknowledgements | Sitemap | Partners | Disclaimer | Contact | ||

|

coordinated by  |

supported by  |

The sole responsibility for the content of this webpage lies with the authors. It does not necessarily reflect the opinion of the European Communities. The European Commission is not responsible for any use that maybe made of the information contained therein. |