MAIN PUBLICATION :

| Home � INDUSTRY & MARKETS � Industry actors... � Value chain trends � IPPs Seek Positions in Increasingly Competitive Market |

|

IPPs Seek Positions in Increasingly Competitive Market

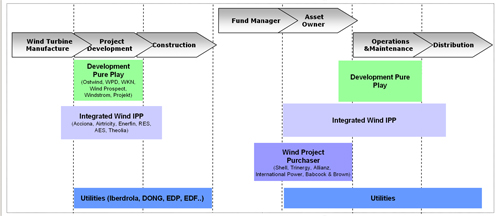

Even before utilities began adopting wind energy, Europe’s vertically-integrated independent power producers (IPPs) started aggressively exploiting wind turbine technology to improve their positioning. Led primarily by Spanish firms that were connected to large construction and industrial companies, the IPP model has evolved in various forms to represent a significant group of players in the value chain.

There are two main types of IPP in Europe: integrated ones, which have capabilities across the project development value chain and exploit these for maximum control and returns on their project portfolio, and wind project buyers, which tend not to play a direct role in the development of wind plants in their portfolio as these firms are often financial investors, rather than energy players. The number of these players that are active has continuously increased over the past three years as utilities have sought acquisitions among this field of asset and pipeline holding competitors, though those that are already a significant size may be positioned for long-term growth.

In terms of development, integrated IPPs are continuing to expand internationally, through greenfield project development and acquisitions, in order to compete with utilities. Players with strongholds in Spain, France or Germany consistently look for growth in Eastern Europe, while some are also taking the plunge offshore. More risk-averse IPPs are seeing the number of quality projects available for acquisition in mature markets continues to dwindle.

As wind power owners, IPPs are facing stiffer competition from utilities as several project portfolios have been acquired in markets such as Spain, Germany, France and the UK. IPPs generally have higher capital costs than utilities and those that can create assets organically through development on their own are generally better positioned to enlarge their portfolio.

As asset managers on the value chain, integrated wind IPPs and project purchases are distinctly different, with integrated players increasingly focusing on O&M to maximise asset values. The boom in MW additions in the last three years means many turbines are coming out of their warranty periods, requiring IPPs to make key strategic decisions on how to manage their installations.

Figure 3.4: Europe Wind Value Chain Positioning Overview

Source: Emerging Energy Research

| Acknowledgements | Sitemap | Partners | Disclaimer | Contact | ||

|

coordinated by  |

supported by  |

The sole responsibility for the content of this webpage lies with the authors. It does not necessarily reflect the opinion of the European Communities. The European Commission is not responsible for any use that maybe made of the information contained therein. |