MAIN PUBLICATION :

| Home � INDUSTRY & MARKETS � European market overview � The European offshore market |

|

The European Offshore Market

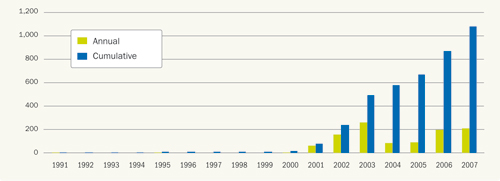

With a total of 1,080 MW by the end of 2007, offshore accounted for 1.9 per cent of installed EU capacity and 3.5 per cent of the electricity production from wind power in the EU (Figure 2.11). The market is still below its 2003 level and development has been slower than previously anticipated.

Fig 2.11: Offshore Wind in the EU (MW)

Source: EWEA

Since 2003, the only country to consistently activate at least one offshore project per year has been the UK, when the 60 MW North Hoyle wind farm was commissioned. Denmark, Europe’s earliest offshore pioneer, has not added any new projects since the 17 MW Ronland wind plant was commissioned in 2004, while Germany's first offshore wind turbine, a N90/2500, was installed in March 2006 in Rostock international port. The Netherlands, Sweden and Ireland are the only other European markets with operational offshore projects.

With 409 MW, Denmark now has the most offshore wind capacity, but the UK (404 MW) is a very close second, having installed 100 MW in 2007. Sweden installed 110 MW in 2007. The Netherlands and Ireland also have operating offshore wind farms.

Table 2.2: European Offshore Capacity End 2007

Country Total installed

by end 2007 (MW)

Installed

in 2007 (MW)

Denmark 409.15 0 United Kingdom 404 100 Sweden 133.25 110 Netherlands 108 0 Ireland 25.2 0 TOTAL 1,079.6 210 Source: EWEA

The main barriers to European offshore wind project development include:

- Lengthy permitting processes that need to consider key issues such as defence, shipping, fishing and tourism;

- Technical issues relating to the construction of the wind farms, including transport of turbines, turbine supports depending on the type of seabed, meteorological restrictions on building a wind farm (often limited to a few months of the year in Northern Europe), and connecting the wind park to the mainland;

- Incentive schemes that are not in line with the existing risks and/or costs associated with offshore investments, making it difficult to finance projects;

- High costs associated with every stage of the project development, from development to construction and turbine size;

- Lack of turbine availability;

- Lack of experience in offshore development;

- Lack of smarter foundation types for deeper waters (>20m); and

- An urgent need for more research and development (R&D) and demonstration projects.

Despite these issues, firms are moving offshore in some European markets, driven by high resources, limited onshore potential or even government pressure. As a result, it is estimated that the market will draw near to 10 per cent of total installed wind power within the next decade.

For the most part, utilities will be the main drivers of growth as firms can finance projects on their balance sheets, although some IPPs are looking at offshore installations in order to secure their position in the European wind energy market. In addition, more offshore opportunities will arise as developers tend to outsource these activities to firms with the technical know-how required for offshore project construction. In terms of turbine suppliers, Siemens and Vestas are currently the main two, although a handful of other firms are looking to challenge this duopoly with machines of 2.5 MW and 5 MW, and even larger models in the design phase.

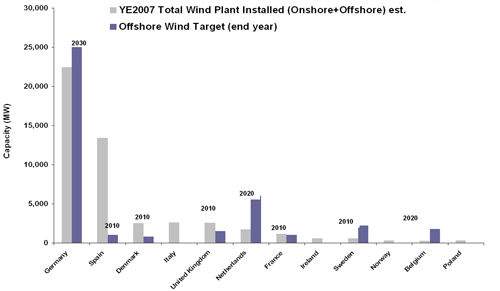

Although Germany, the UK and Sweden are positioned to become the largest European offshore markets, other markets are now also ready to move offshore, exploiting existing resources. France’s first offshore projects are due to be commissioned in 2008-2010, while in Spain several initiatives have been launched by key IPPs and utilities for large-scale projects, mainly in the Sea of Trafalgar and off the coast of Valencia. In Italy, Enel claims that it will develop a 150–200 MW wind farm in the Mediterranean.

Fig 2.12: Europe Offshore Market Installed and Targets by Country

Source: Governments, Emerging Energy Research

| Acknowledgements | Sitemap | Partners | Disclaimer | Contact | ||

|

coordinated by  |

supported by  |

The sole responsibility for the content of this webpage lies with the authors. It does not necessarily reflect the opinion of the European Communities. The European Commission is not responsible for any use that maybe made of the information contained therein. |