MAIN PUBLICATION :

| Home � INDUSTRY & MARKETS � Industry actors... |

|

CHAPTER 3: INDUSTRY ACTORS AND INVESTMENT TRENDS

Wind Turbine Manufacturing Trends

The global wind turbine market remains regionally segmented due to the wide variations in demand. With markets developing at different speeds and because there are different resource characteristics everywhere, market share for turbine supply has been characterised by national industrial champions, highly focused technology innovators, and new start-ups licensing proven technology from other regions.

The industry is becoming ever more globalised. Europe’s manufacturing pioneers have begun to penetrate North America and Asia. Wind turbine sales and supply chain strategies will take on a more international dimension as volumes increase.

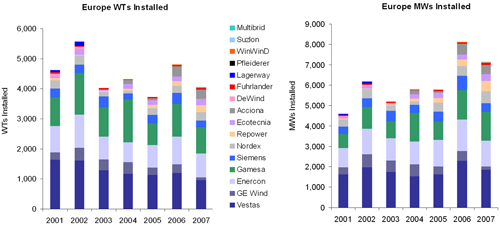

As the region responsible for pioneering widespread, larger-scale uptake of wind power, Europe hosts the strongest competition for market share, with roughly a dozen suppliers. The European market has seen highly stable market share distribution with few major shifts since a round of consolidation among leading suppliers in 2003–2004. Between 2004 and 2007, three players held an average of over 15 per cent of the annual market share, followed by four players with a 5 to 10 per cent share each. During the same period, a handful of other players with a less than 5 per cent market share vied to establish themselves in the market for longer-term positioning. In Europe, manufacturers are primarily focusing on Class II machines of 2 MW and larger. There are several key players in this competitive region:

- Global leader Vestas averaged 30 per cent of annual MW added in Europe between 2001 and 2007 and is competing for offshore dominance with its 3 MW, V90 turbine;

- Enercon, Vestas’ chief European rival, has held steady at 20 per cent of MW supplied since 2001 with its bestselling 2 MW, E-80 turbine;

- Gamesa has settled at 18-19 per cent of European MW added annually since 2005, based on steady sales of its 2 MW G80 turbine;

- Siemens has maintained 7-10 per cent of annual installations since acquiring Bonus in 2004, leveraging the success of the 2.3 MW turbine offshore and 3.6 MW turbine offshore;

- GE has shifted much of its sales focus from Europe to its home US market with its 1.5 MW platform, and has seen its market share drop from 11 per cent in 2003 to 2 per cent in 2007, though it is seeking to regain its position with its 2.5 MW turbine;

- Nordex averaged 6 per cent of annual MW installed in Europe between 2001 and 2007, mainly due to steady sales in France and its home market Germany, followed by Portugal and other markets, where it mainly deploys its 2.3-2.5 MW N90 series;

- Other suppliers looking for market positioning include Acciona Windpower, Alstom Ecotécnia, and REpower with 5 per cent or less of the market; and

- At the same time, Pfleiderer licensees WinWinD and Multibrid are continuing to scale up their pilot turbines, while Fuhrländer continued its lower volume deliveries in Germany.

Fig 3.1: European Wind Turbine Market Share, 2001–2007

Source: Suppliers, Emerging Energy Research

| Acknowledgements | Sitemap | Partners | Disclaimer | Contact | ||

|

coordinated by  |

supported by  |

The sole responsibility for the content of this webpage lies with the authors. It does not necessarily reflect the opinion of the European Communities. The European Commission is not responsible for any use that maybe made of the information contained therein. |