MAIN PUBLICATION :

| Home � INDUSTRY & MARKETS � Industry actors... � Key player positioning |

|

Key Player Positioning

Europe’s shifting distribution of wind power asset ownership clearly illustrates the industry’s scaling up and geographic expansion. From an industry concentrated in Denmark and Germany with single, farmer-owned turbines at the end of the 1990s, wind power ownership now includes dozens of multinational players that own several GWs of installed capacity. The European market is made up of five main ownership types:

- Utilities. This group is made up of over twenty utilities including pan-European, regional and local players that hold incumbent positions in electricity distribution and generation, and often transmission.

- Top IPPs. Members of this group own over 300 MW each, mainly including vertically-integrated players primarily working in Spain, Germany, France, UK and Italy.

- Other Spanish IPPs are all independent power producers with a presence in Spain, except for the Top 20 IPPs with a presence in this market. Spain’s heavy weighting in the European wind market, at 25 of total installed capacity represents a major ownership block for these players.

- German Investors. This block is composed of IPPs as well as institutional and private investors that own significant shares of Germany’s total installed capacity of over 22GW, or 40 of the European market.

- Other European Investors/IPPs. This group includes private and institutional investors and IPPs with a wind presence in European countries other than Spain and Germany and which are not among Europe´s largest wind power operators.

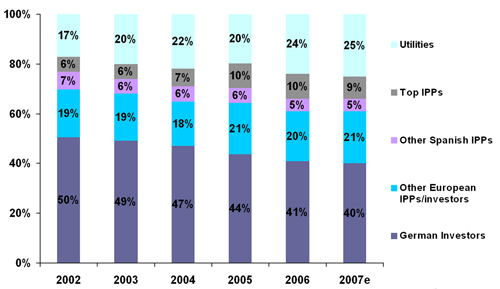

Over the past five years, the most salient trend has been the increased participation of utilities in the industry. Utilities’ share of the total wind power installed increased from 17 per cent in 2002 to 25 per cent in 2007. The biggest jump took place between 2005 and 2006, when the region’s top wind utilities saw annual additions of well over 500 MW. With consolidation in Europe’s mature and scaling markets, it is anticipated that utilities and IPPs will have a bigger role in the future. Utility growth will be largely driven by pan-regional players realising their near-term projects, which currently range from 1,000 MW to 4,000 MW.

IPPs will also continue to increase their participation in wind, led by experienced vertical integrated players and larger investors able to develop internally or buy turnkey and leverage their strong financial capacity. At the same time, several of these firms may fall prey to expanding utilities, as seen in the past year, in which these firms’ share fell to 9 per cent. While German investors will continue to be the largest wind power ownership block in the next few years, their participation will diminish over time as Germany´s contribution to Europe´s total wind power market decreases. On the other hand, Spanish IPPs are expected to decline in the near term despite the Spanish market’s continued growth, as these smaller IPPs are either acquired by larger players or struggle to realise their modest pipelines amidst an increasingly competitive development environment.

Figure 3.5: European Ownership Shifts to Utilities, IPPs

Source: Emerging Energy Research

| Acknowledgements | Sitemap | Partners | Disclaimer | Contact | ||

|

coordinated by  |

supported by  |

The sole responsibility for the content of this webpage lies with the authors. It does not necessarily reflect the opinion of the European Communities. The European Commission is not responsible for any use that maybe made of the information contained therein. |