MAIN PUBLICATION :

| Home � ECONOMICS � Prices and support mechanisms � Overview of the different RES-E support schemes in EU-27 countries |

|

Overview of the Different RES-E Support Schemes in EU-27 Countries

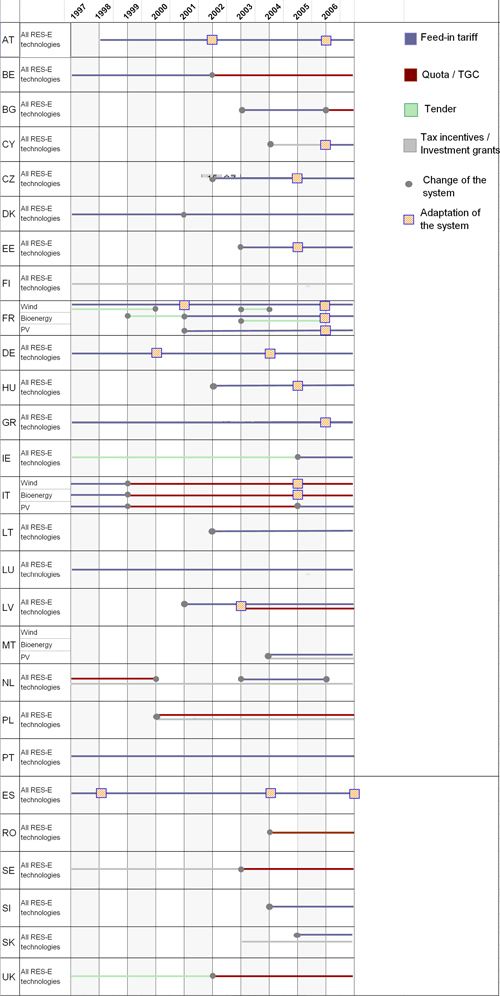

Figure 4.1 shows the evolution of the different RES-E support instruments from 1997-2007 in each of the EU-27 Member States. Some countries already have more than ten years’ experience with RES-E support schemes.

Figure 4.1: Evolution of the Main Policy Support Schemes in EU-27 Member States

Source: Ragwitz et al. (2007)

Initially, in the ‘old’ EU-15, only eight out of the 15 Member States avoided a major policy shift between 1997 and 2005. The current discussion within EU Member States focuses on the comparison between two opposing systems - the FIT system and the quota regulation in combination with a TGC-market. The latter has recently replaced existing policy instruments in some European countries, such as Belgium, Italy, Sweden, the UK and Poland. Although these new systems were not introduced until after 2002, the announced policy changes caused investment instabilities prior to this date. Other policy instruments, such as tender schemes, are no longer used as the main policy scheme in any European country. However, there are instruments, such as production tax incentives and investment incentives, that are frequently used as supplementary instruments; only Finland and Malta use them as their main support scheme.

Table 4.2 gives a detailed overview of the main support schemes for wind energy in the EU-27 Member States.

Table 4.2: Overview of the Main RES-E Support Schemes for Wind Energy in the EU-27 Member States as Implemented in 2007

Country Main Support Instrument for Wind Settings of the Main Support Instrument for Wind in Detail Austria FIT New fixed feed-in tariff valid for new RES-E plants permitted in 2006 and/or 2007: fixed FIT for years 1-9 (76.5 €/MWh for year 2006 as a starting year; 75.5 €/MWh for year 2007). Years 10 and 11 at 75 per cent and year 12 at 50 per cent. Belgium Quota obligation system with TGC; combined with minimum price for wind Flanders, Wallonia and Brussels have introduced a quota obligation system (based on TGCs). The minimum price for wind onshore (set by the federal government) is 80 €/MWh in Flanders, 65 €/MWh in Wallonia and 50 €/MWh in Brussels. Wind offshore is supported at the federal level, with a minimum price of 90 €/MWh (the first 216 MW installed: 107 €/MWh minimum). Bulgaria Mandatory Purchase Price Mandatory purchase prices (set by State Energy Regulation Commission): new wind installations after 01/01/2006 (duration 12 years each): (i) effective operation >2250 h/a: 79.8 €/MWh; (ii) effective operation <2250 h/a: 89.5 €/MWh. Cyprus FIT Fixed feed-in tariff since 2005: in the first five years 92 €/MWh based on mean values of wind speeds; in the next ten years 48-92 €/MWh according to annual wind operation hours (<1750-2000h/a: 85-92 €/MWh; 2000-2550h/a: 63-85 €/MWh; 2550-3300h:/a 48-63 €/MWh). Czech Republic Choice between FIT and Premium Tariff Fixed feed-in tariff: 88-114 €/MWh in 2007 (duration: equal to the lifetime); Premium tariff: 70-96 €/MWh in 2007 (duration: newly set every year). Denmark Market Price and Premium for Wind Onshore;

Tendering System for Wind OffshoreWind onshore: Market price plus premium of 13 €/MWh (20 years); additionally, balancing costs are refunded at 3 €/MWh, leading to a total tariff of approximately 57 €/MWh.

Wind offshore: 66-70 €/MWh (i.e. Market price plus a premium of 13 €/MWh); a tendering system is applied for future offshore wind parks, balancing costs are borne by the owners.Estonia FIT Fixed feed-in tariff for all RES: 52 €/MWh (from 2003 - present); current support mechanisms will be terminated in 2015. Finland Tax Exemptions and Investment Subsidies Mix of tax exemptions (refund) and investment subsidies: Tax refund of 6.9 €/MWh for wind (4.2 €/MWh for other RES-E). Investment subsidies up to 40 for wind (up to 30 for other RES-E). France FIT Wind onshore: 82 €/MWh for ten years; 28-82 €/MWh for the following five years (depending on the local wind conditions).

Wind offshore:130 €/MWh for 10 years; 30-130 €/MWh for the following 10 years (depending on the local wind conditions).Germany FIT Wind onshore (20 years in total): 83.6 €/MWh for at least 5 years; 52.8 €/MWh for further 15 years (annual reduction of 2 is taken into account).

Wind offshore (20 years in total): 91 €/MWh for at least 12 years; 61.9 €/MWh for further eight years (annual reduction of 2 taken into account).Greece FIT Wind onshore: 73 €/MWh (Mainland); 84.6 €/MWh (Autonomous Islands).

Wind Offshore: 90 €/MWh (Mainland); 90 €/MWh (Autonomous Islands);

Feed-in tariffs guaranteed for 12 years (possible extension up to 20 years).Hungary FIT Fixed feed-in tariff (since 2006): 95 €/MWh; duration: according to the lifetime of technology. Ireland FIT Fixed feed-in tariff (since 2006); guaranteed for 15 years:

Wind > 5MW: 57 €/MWh;

Wind < 5MW: 59 €/MWh.Italy Quota obligation system with TGC Obligation (based on TGCs) on electricity producers and importers. Certificates are issued for RES-E capacity during the first 12 years of operation, except biomass which receives certificates for 100 per cent of electricity production for first eight years and 60 per cent for next 4 years. In 2005 the average certificate price was 109 €/MWh. Latvia Main policy support instrument currently under development Frequent policy changes and short duration of guaranteed feed-in tariffs (phased out in 2003) result in high investment uncertainty. Main policy currently under development. Lithuania FIT Fixed feed-in tariff (since 2002): 63.7 €/MWh; guaranteed for ten years. Luxemburg FIT Fixed feed-in tariff: (i) <0.5 MW: 77.6 €/MWh; (ii) >0.5 MW: max. 77.6 €/MWh (i.e. decreasing for higher capacities); guaranteed for ten years. Malta No support instrument yet Very little attention to RES-E (also wind) support so far. A low VAT rate is in place. Netherlands Premium Tariff (0 €/MWh since August 2006) Premium feed-in tariffs guaranteed for ten years were in place from July 2003. For each MWh RES-E generated, producers receive a green certificate. Certificate is then delivered to feed-in tariff administrator to redeem tariff. Government put all premium RES-E support at zero for new installations from August 2006 as it believed target could be met with existing applicants. Poland Quota obligation system. TGCs introduced end 2005 plus renewables are exempted from excise tax Obligation on electricity suppliers with RES-E targets specified from 2005 to 2010. Poland has an RES-E and primary energy target of 7.5 per cent by 2010. RES-E share in 2005 was 2.6 per cent of gross electricity consumption. Portugal FIT Fixed feed-in tariff (average value 2006): 74 €/MWh; guaranteed for 15 years. Romania Quota obligation system with TGCs Obligation on electricity suppliers with targets specified from 2005 (0.7 per cent RES-E) to 2010 (8.3 per cent RES-E). Minimum and maximum certificate prices are defined annually by Romanian Energy Regulatory Authority. Non-compliant suppliers pay maximum price (i.e. 63 €/MWh for 2005-2007; 84 €/MWh for 2008-2012). Slovakia FIT Fixed feed-in tariff (since 2005): 55-72 €/MWh; FITs for wind are set that way so that a rate of return on the investment is 12 years when drawing a commercial loan. Slovenia Choice between FIT and premium tariff Fixed feed-in tariff: (i) <1MW: 61 €/MWh; (ii) >1MW: 59 €/MW.

Premium tariff: (i) <1MW: 27 €/MWh; (ii) >1MW: 25 €/MWh.

Fixed feed-in tariff and premium tariff guaranteed for 5 years, then reduced by 5 per cent.

After ten years reduced by 10 per cent (compared to original level).Spain Choice between FIT and premium tariff Fixed feed-in tariff: (i) <5MW: 68.9 €/MWh; (ii) >5MW: 68.9 €/MWh;

Premium tariff: (i) <5MW: 38.3 €/MWh; (ii) >5MW: 38.3 €/MWh;

Duration: no limit, but fixed tariffs are reduced after either 15, 20 or 25 years, depending on technology.Sweden Quota obligation system with TGCs Obligation (based on TGCs) on electricity consumers. Obligation level of 51 per cent RES-E defined to 2010. Non-compliance leads to a penalty, which is fixed at 150 per cent of the average certificate price in a year (average certificate price was 69 €/MWh in 2007). UK Quota obligation system with TGCs Obligation (based on TGCs) on electricity suppliers. Obligation target increases to 2015 (15.4 per cent RES-E; 5.5 per cent in 2005) and guaranteed to stay at least at that level until 2027. Electricity companies which do not comply with the obligation have to pay a buy-out penalty (65.3 €/MWh in 2005). Tax exemption for electricity generated from RES is available. Source: Auer (2008)

In Table 4.3, a more detailed overview is provided on implemented RES-E support schemes in the EU-27 Member States in 2007, detailing countries, strategies and the technologies addressed. In the EU-27, FITs serve as the main policy instrument.

For a detailed overview of the EU Member States’ support schemes, please refer to Appendix I.

Table 4.3: Overview of the Main RES-E Support Schemes in the EU-27 Member States as Implemented in 2007

Country Main electricity support schemes Comments Austria FITs combined with regional investment incentives Until December 2004, FITs were guaranteed for 13 years. In November 2005 it was announced that from 2006 onwards full FITs would be available for ten years, with 75 per cent available in year 11 and 50 per cent in year 12. New FIT levels are announced annually and support is granted on a first-come, first-served basis. From May 2006 there has been a smaller government budget for RES-E support. At present, a new amendment is tabled, which suggests extending the duration of FIT fuel-independent technologies to 13 years (now ten years) and fuel-dependent technologies to 15 years (now ten years). Belgium Quota obligation system/TGC combined with minimum prices for electricity from RES The federal government has set minimum prices for electricity from RES.

Flanders and Wallonia have introduced a quota obligation system (based on TGCs) with the obligation on electricity suppliers. In all three of the regions, including Brussels, a separate market for green certificates has been created. Offshore wind is supported at the federal level.Bulgaria Mandatory purchase of renewable electricity by electricity suppliers for minimum prices (essentially FITs) plus tax incentives The relatively low level of incentives makes the penetration of renewables particularly difficult, since the current commodity prices for electricity are still relatively low. A green certificate system to support renewable electricity developments has been proposed, for implementation in 2012, to replace the mandatory purchase price. Bulgaria recently agreed upon an indicative target for renewable electricity with the European Commission, which is expected to provide a good incentive for further promotion of renewable support schemes. Cyprus FITs (since 2006), supported by investment grant scheme for the promotion of RES An Enhanced Grant Scheme was introduced in January 2006, in the form of government grants worth 30-55 per cent of investment, to provide financial incentives for all renewable energy. FITs with long-term contracts (15 years) were also introduced in 2006. Czech Republic FITs (since 2002), supported by investment grants Relatively high FITs with a lifetime guarantee of support. Producers can choose fixed FITs or a premium tariff (green bonus). For biomass cogeneration, only green bonus applies. FIT levels are announced annually, but are increased by at least 2 per cent each year. Denmark Premium FIT for onshore wind, tender scheme for offshore wind, and fixed FITs for others Duration of support varies from 10-20 years, depending on the technology and scheme applied. The tariff level is generally rather low compared to the formerly high FITs. A net metering approach is taken for photovoltaics. Estonia FIT system FITs paid for 7-12 years, but not beyond 2015. Single FIT level for all RES-E technologies. Relatively low FITs make new renewable investments very difficult. Finland Energy tax exemption combined with investment incentives Tax refund and investment incentives of up to 40 per cent for wind, and up to 30 per cent for electricity generation from other RES. France FITs plus tenders for large projects For power plants < 12 MW, FITs are guaranteed for 15 or 20 years (offshore wind, hydro and PV).

From July 2005, FIT for wind is reserved for new installations within special wind energy development zones.

For power plants > 12 MW (except wind) a tendering scheme is in place.Germany FITs FITs are guaranteed for 20 years (Renewable Energy Act) and soft loans are also available. Greece FITs combined with investment incentives FITs are guaranteed for 12 years with the possibility of extension up to 20 years. Investment incentives up to 40 per cent. Hungary FIT (since Jan 2003, amended 2005) combined with purchase obligation and grants Fixed FITs recently increased and differentiated by RES-E technology. There is no time limit for support defined by law, so in theory guaranteed for the lifetime of the installation. Plans to develop TGC system; when this comes into effect, the FIT system will cease to exist. Ireland FIT scheme replaced tendering scheme in 2006

New premium FITs for biomass, hydropower and wind started in 2006. Tariffs guaranteed to supplier for up to 15 years. Purchase price of electricity from the generator is negotiated between generators and suppliers. However, support may not extend beyond 2024, so guaranteed premium FIT payments should start no later than 2009. Italy Quota obligation system with TGC

Fixed FIT for PVObligation (based on TGCs) on electricity producers and importers. Certificates are issued for RES-E capacity during the first 12 years of operation, except for biomass, which receives certificates for 100 per cent of electricity production for the first eight years and 60 per cent for the next four years.

Separate fixed FIT for PV, differentiated by size, and building integrated. Guaranteed for 20 years. Increases annually in line with retail price index.Latvia Main policy under development.

Quota obligation system (since 2002) no TGCs, combined with FITs (phased out in 2003)Frequent policy changes and short duration of guaranteed FITs result in high investment uncertainty. Main policy currently under development.

Quota system (without TGCs) typically defines small RES-E amounts to be installed. High FIT scheme for wind and small hydropower plants (less than 2 MW) was phased out as from January 2003.Lithuania FITs combined with purchase obligation. Relatively high fixed FITs for hydro (<10 MW), wind and biomass, guaranteed for ten years.

Closure of Ignalina nuclear plant, which currently supplies the majority of electricity in Lithuania, will strongly affect electricity prices and thus the competitive position of renewables, as well as renewable support. Good conditions for grid connections. Investment programmes limited to companies registered in Lithuania. Plans exist to introduce a TGC system after 2010.Luxembourg FITs FITs guaranteed for 10 years (20 years for PV). Also investment incentives available. Malta Low VAT rate and very low FIT for solar Very little attention to RES support so far. Very low FIT for PV is a transitional measure. Netherlands FITs (tariff zero from August 2006) Premium FITs guaranteed for ten years have been in place since July 2003. For each MWh RES-E generated, producers receive a green certificate from the issuing body (CERTIQ). Certificate is then delivered to FIT administrator (ENERQ) to redeem tariff.

Government put all premium RES-E support at zero for new installations from August 2006 as believed target could be met with existing applicants. Premium for biogas (<2 MWe) immediately reinstated. New support policy under development.

Fiscal incentives for investments in RES are available.

Energy tax exemption for electricity from RES ceased 1 January 2005.Poland Quota obligation system. TGCs introduced from end 2005, plus renewables are exempted from the (small) excise tax Obligation on electricity suppliers with targets specified from 2005 to 2010. Penalties for non-compliance were defined in 2004, but were not properly enforced until end of 2005. It has been indicated that from 2006 onwards the penalty will be enforced.

Portugal FITs combined with investment incentives Fixed FITs guaranteed for 15 years. Level dependent on time of electricity generation (peak/ off peak), RES-E technology, resource. Is corrected monthly for inflation.

Investment incentives up to 40 per cent.Romania Quota obligation with TGCs, subsidy fund (since 2004) Obligation on electricity suppliers with targets specified from 2005 to 2010. Minimum and maximum certificate prices are defined annually by Romanian Energy Regulatory Authority. Non-compliant suppliers pay maximum price.

Romania recently agreed on an indicative target for renewable electricity with the European Commission, which is expected to provide a good incentive for further promotion of renewable support schemes.SlovakRepublic Programme supporting RES and energy efficiency, including FITs and tax incentives Fixed FIT for RES-E was introduced in 2005. Prices set so that a rate of return on the investment is 12 years when drawing a commercial loan.

Low support, lack of funding and lack of longer-term certainty in the past have made investors very reluctant.Slovenia FITs, CO2 taxation and public funds for environmental investments Renewable electricity producers choose between fixed FITs and premium FITs. Tariff levels defined annually by Slovenian Government (but have not changed since 2004).

Tariff guaranteed for five years, then reduced by 5 per cent. After ten years, reduced by 10 per cent (compared to original level). Relatively stable tariffs combined with long-term guaranteed contracts makes system quite attractive to investors.Spain FITs Electricity producers can choose a fixed FIT or a premium on top of the conventional electricity price. No time limit, but fixed tariffs are reduced after either 15, 20 or 25 years depending on technology. System very transparent. Soft loans, tax incentives and regional investment incentives are available. Sweden Quota obligation system with TGCs Obligation (based on TGCs) on electricity consumers. Obligation level defined to 2010. Non-compliance leads to a penalty, which is fixed at 150 per cent of the average certificate price in a year. Investment incentive and a small environmental bonus available for wind energy. UK Quota obligation system with TGCs Obligation (based on TGCs) on electricity suppliers. Obligation target increases to 2015 and guaranteed to stay at that level (as a minimum) until 2027. Electricity companies that do not comply with the obligation have to pay a buy-out penalty. Buy-out fund is recycled back to suppliers in proportion to the number of TGCs they hold. The UK is currently considering differentiating certificates by RES-E technology.

Tax exemption for electricity generated from RES is available (Levy Exemption Certificates which give exemption from the Climate Change Levy).Source: Ragwitz et al. (2007)

| Acknowledgements | Sitemap | Partners | Disclaimer | Contact | ||

|

coordinated by  |

supported by  |

The sole responsibility for the content of this webpage lies with the authors. It does not necessarily reflect the opinion of the European Communities. The European Commission is not responsible for any use that maybe made of the information contained therein. |