MAIN PUBLICATION :

| Home � SCENARIOS & TARGETS � Global scenarios � Chapter 5: Global scenarios |

|

CHAPTER 5: GLOBAL SCENARIOS

Global Market Forecast for 2008-2012

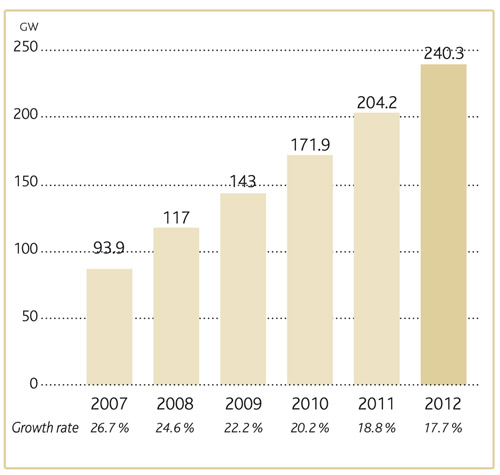

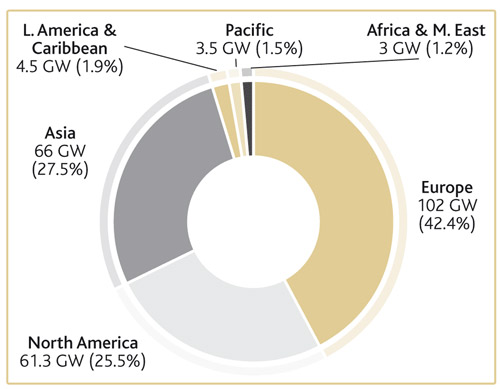

The Global Wind Energy Council (GWEC) predicts that the global wind market will grow by over 155 per cent from 2007 to reach 240.3 GW of total installed capacity by 2012 (GWEC, 2008). This would represent an addition of 146.2 GW in five years, attracting investment of over €180 billion (US$277 billion, both in 2007 values). The electricity produced by wind energy will reach over 500 TWh in 2012 (up from 200 TWh in 2007), accounting for around 3 per cent of global electricity production (up from just over 1 per cent in 2007).

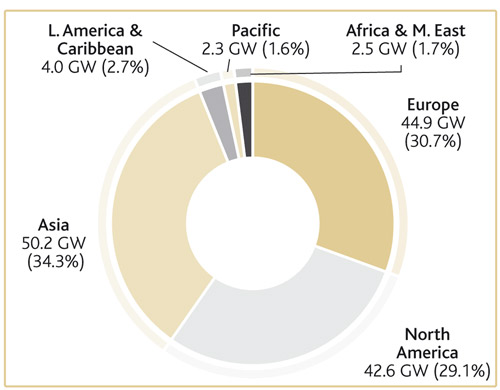

The main areas of growth during this period will be North America and Asia, more specifically the US and China. The emergence of significant manufacturing capacity in China by foreign and domestic companies will also have an important impact on the growth of the global markets. While tight production capacity is going to remain the main factor limiting further market growth, Chinese production may help take some of the strain out of the current supply situation. The average growth rates during this five-year period in terms of total installed capacity are expected to be 20.7 per cent, compared with 23.4 per cent during 2003–2007. In 2012, Europe will continue to house the largest wind energy capacity, with a total of 102 GW, followed by Asia with 66 GW and North America with 61.3 GW.

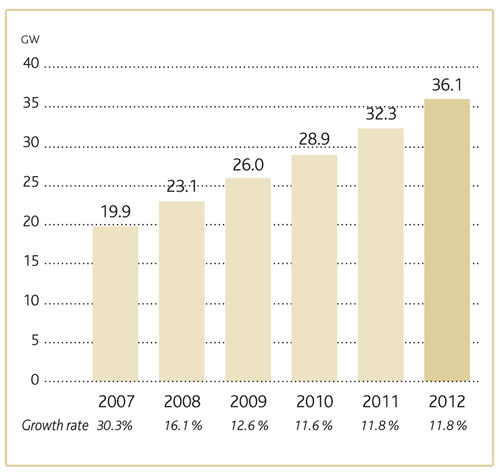

The yearly additions in installed capacity are predicted to grow from 19.9 GW in 2007 to 36.1 GW in 2012, with an average growth rate of 12.7 per cent. Considering that annual markets have been increasing by an average of 24.7 per cent over the last five years, growth could be much stronger in the future were it not for continuing supply chain difficulties which will considerably limit the growth of annual markets for the next two years. This problem should be overcome by 2010, and along with the development of the offshore market, growth rates are expected to recover in the next decade.

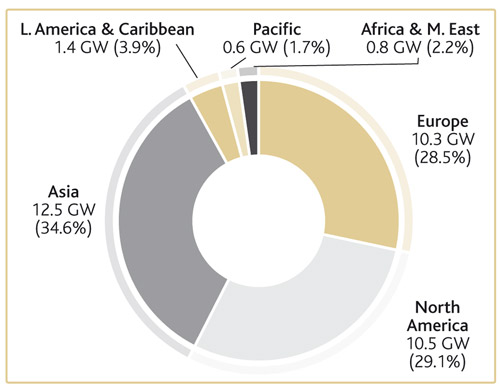

GWEC predicts that Asia will install 12.5 GW of new wind generating capacity in 2012, up from 5.2 GW in 2007. This growth will be mainly led by China, which since 2004 has doubled its total capacity every year, thereby consistently exceeding even the most optimistic predictions. By 2010, China could be the biggest national market globally. This development is underpinned by a rapidly growing number of domestic and foreign manufacturers operating in the Chinese market. While China will emerge as the continental leader in Asia, sustained growth is also foreseen in India, while other markets such as Japan, South Korea and Taiwan will also contribute to the development of wind energy on the continent.

By 2012, the European market should stand at 10.3 GW – the same size as the North American market (10.5 GW). Overall, this means that over 29 per cent of global new installations will take place in Europe in 2012. In terms of total installed capacity, Europe will continue to be the biggest regional market, with 42.4 per cent of all wind power capacity installed in the world by the end of 2012.

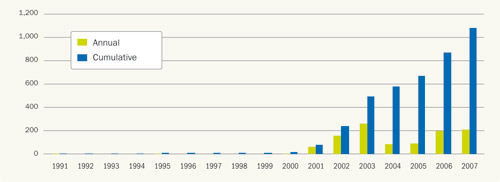

Figure 5.1: Offshore Wind in the EU

Source: EWEA (2008a)

The large-scale development of offshore wind energy will only start to have a significant impact on European market growth towards the end of the time period under consideration. However, it is expected that offshore development will lend momentum to growth in Europe during the next decade.

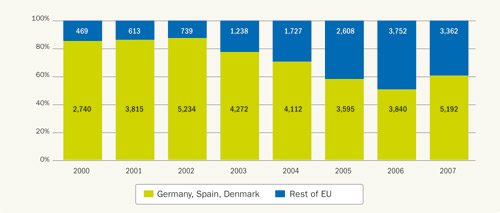

In Europe, Germany and Spain will remain the leading markets, but their relative weight will decrease as other national markets emerge on the scene. While the spectacular growth of the Spanish market in 2007, with over 3.5 GW of new installations, will not be sustained, a stable pace of 2–2.5 GW per year on average can be expected, enabling Spain to reach the government’s 2010 target of 20 GW. The size of the German annual market will decrease, but it will remain the second strongest European market for the 2008–2012 period and the biggest in terms of total installed capacity. By 2010, offshore developments will give new impetus to the German market, resulting in stronger growth. Other important markets in Europe will be France and the UK, each increasing by an average of 1 GW per year.

Figure 5.2: Germany, Spain and Denmark’s Share of EU market, 2000-2007

Source: EWEA (2008a)

The North American market will see strong growth, led by the US, with the Canadian market maintaining its development. In total, North America will see an addition of 42.6 GW in the next five years, reaching 61.3 GW of total capacity in 2012. This represents an average of 8.5 GW of new capacity added every year (the bulk of which is in the US).

These figures assume that the US Production Tax Credit (PTC) will be renewed in time for the current strong growth to continue. If it is not, the 2009 market could suffer. However, the high-level engagement of an increasing number of US states, 27 of which have already introduced Renewable Portfolio Standards, will also assure sustained growth. A change in the US administration may further underpin this development.

Latin America is expected to contribute more substantially to the global total in the future, mainly driven by Brazil, Mexico and Chile. By 2012, the total installed capacity in Latin America and the Caribbean will increase eightfold to reach 4.5 GW, and an annual market of 1.4 GW. However, despite its tremendous potential, Latin America is likely to remain a small market until the end of the period under consideration, progressing towards more significant development in the next decade.

The Pacific region will see around 2.3 GW of new installations in 2008–2012, bringing the total up to 3.5 GW. While in Australia, wind energy development slowed down considerably in 2006 and 2007, the outlook for the future is more optimistic, mainly thanks to the change in federal government at the end of 2007, the ratification of the Kyoto Protocol and the pledge to implement a new target for 20 per cent of electricity from renewables by 2020. New Zealand, however, got new impetus with 151 MW of new installations in 2007, and many more projects are at various stages of development.

Africa and the Middle East will remain the region with the smallest wind energy development, with a total installed capacity of 3 GW by 2012, up from 500 MW in 2012. However, it is expected that market growth will pick up in the coming five years, with annual additions reaching around 800 MW by 2012. This development will be driven by Egypt and Morocco, with some development also predicted in other North African and Middle Eastern countries.

Fig 5.3: Annual Global Installed Capacity, 2007-2012

Source: GWEC

Fig 5.4: Cumulative Global Installed Capacity, 2007-2012

Source: GWEC

Fig 5.5: New Global Installed Capacity, 2008-2012

Source: GWEC

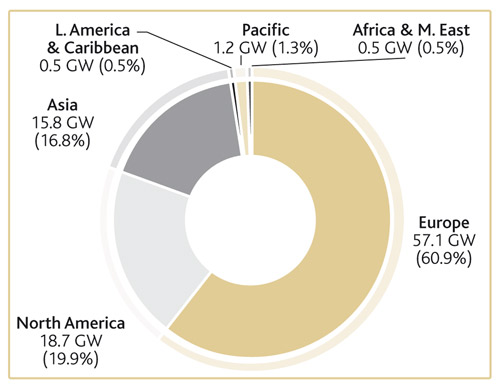

Fig 5.6: Cumulative Global Installed Capacity, End 2007

Source: GWEC

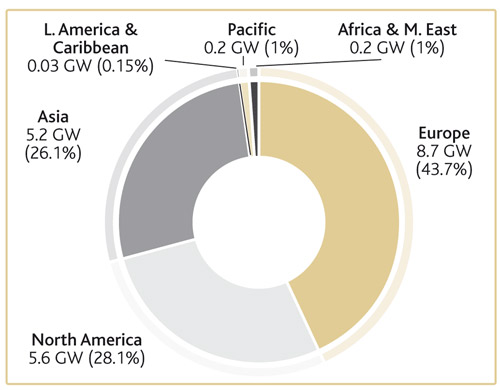

Fig 5.7: Annual Capacity in 2007

Source: GWEC

Fig 5.8: Cumulative Capacity End 2012

Source: GWEC

Fig 5.9: Annual Capacity in 2012

Source: GWEC

| Acknowledgements | Sitemap | Partners | Disclaimer | Contact | ||

|

coordinated by  |

supported by  |

The sole responsibility for the content of this webpage lies with the authors. It does not necessarily reflect the opinion of the European Communities. The European Commission is not responsible for any use that maybe made of the information contained therein. |