MAIN PUBLICATION :

| Home � GRID INTEGRATION � Economic aspects � Wind Power Will Reduce Future European Power Prices |

|

Wind Power will Reduce Future European Power Prices

In a 2008 study, Econ Pöyry used its elaborate power model to investigate the electricity price effects of increasing wind power in Europe to 13 per cent in 2020.

In a business as usual scenario, it is assumed that the internal power market and additional investments in conventional power will more or less levelise the power prices across Europe up until 2020 (reference scenario). However, in a large-scale wind scenario (wind covering 13 per cent of EUs electricity consumption) this might not be the case.

In areas where power demand is not expected to increase very much and in areas where the amount of new deployment of wind energy is larger than the increase in power demand, wind energy will substitute the most expensive power plants. This will lower the price levels in these areas, the study shows.

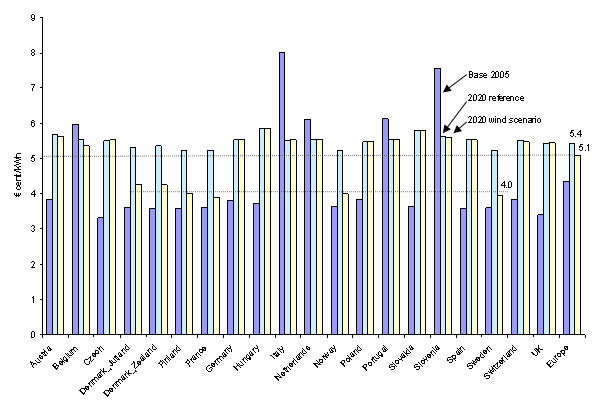

In the EU, the expected price level is around 5.4 cent €/kWh on average in 2020 for the reference case (Figure 7.2) with a slightly higher price at the continent than in the Nordic countries, but with smaller price differences than today.

Figure 7.2: Price levels – in 2005, in the Reference and Wind Scenarios 2020

Source: Econ-Pöyry

In the wind scenario, the average price level in the EU decreases from 5.4 to 5.1 cent €/kWh compared to the reference scenario. However, the effects on power prices are different in the hydropower dominated Nordic countries than in the thermal based countries at the European continent.

In the wind scenario, wind energy is reducing power prices to around 4 cent €/kWh in the Nordic countries. Prices in Germany and the UK remain at the higher level. In other words, a larger amount of wind power would create larger price differences between the (hydro-dominated) Nordic countries and the European continent.

One implication of price decreases in the Nordic countries is that conventional power production becomes less profitable. For large-scale hydropower the general water value decreases. In Norway, hydropower counts for the major part of the power production. However, large-scale implementation of wind creates a demand for flexible production that can deliver balancing services – opening up a window of opportunities for flexible production such as hydropower.

With large amounts of wind in the system, there will be an increased need for interconnection. This is also confirmed by the fact that, in the Econ-Pöyro model runs, with 13 per cent wind in the system compared to the reference scenario, the congestion rent (i.e. the cable income) increases on most transmission lines. This is also something one would expect: With more volatility in the system, there is a need for further interconnection in order to be better able to balance the system.

In order to simulate the effect of further interconnection, we therefore repeated the same model runs as above, i.e. the Wind and the Reference Scenario, but this time with a 1,000 MW inter-connector between Norway and Germany in place, the so-called NorGer Cable. When running the Wind Scenario, Econ-Pöyro found that the congestion rent on such a cable would be around €160 million in the year 2020 in the Reference Scenario, while it would be around €200 million in the Wind Scenario.

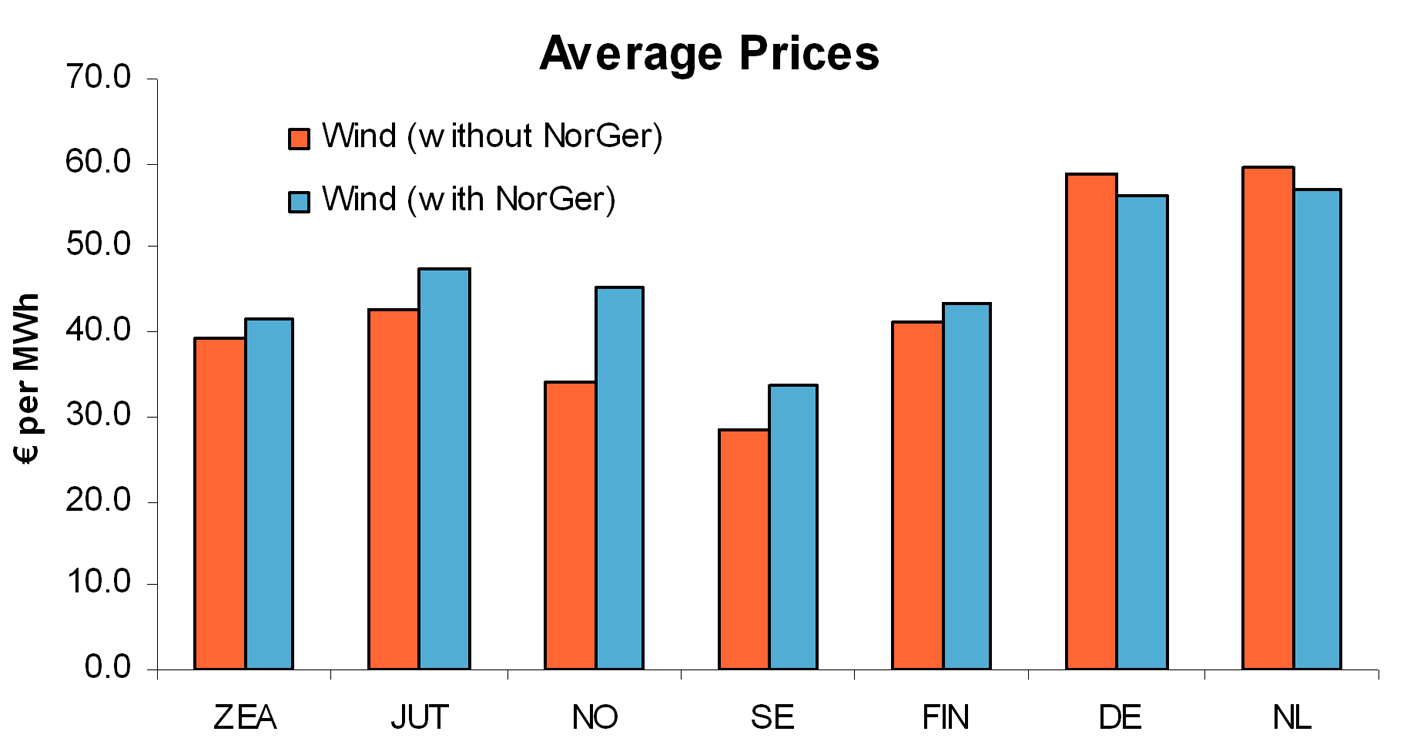

With the cable in place it should first be observed that such a cable would have a significant effect on the average prices in the system, not only in Norway and Germany, but also the other countries in the model. This is illustrated by Figure 7.3 below. In the Nordic area the average prices are increased – the Nordic countries would import the higher prices in Northern continental Europe - while in Germany (and the Netherlands) they are decreased. This is because, in the high peak price hours, power is flowing from Norway to Germany. This is reducing the peak prices in Germany, while it increases the water values in Norway. In the off-peak low price hours, the flow reverses, with Germany exporting to Norway in those hours where prices in Germany are very low. This increases off-peak prices in Germany and decreases water values. However, the overall effect is higher prices in Norway and lower prices in Germany, compared to the situation without a cable). Although such effects are to be expected, this does not always have to be the case. In other cable analysis projects Econ-Pöyro found that an interconnector between a thermal high price area and a hydro low price area may well reduce prices in both areas.

Figure 7.3: Average Prices in the Wind Scenario - With and Without the NorGer Cable

| Acknowledgements | Sitemap | Partners | Disclaimer | Contact | ||

|

coordinated by  |

supported by  |

The sole responsibility for the content of this webpage lies with the authors. It does not necessarily reflect the opinion of the European Communities. The European Commission is not responsible for any use that maybe made of the information contained therein. |