MAIN PUBLICATION :

| Home ´┐Ż INDUSTRY & MARKETS ´┐Ż Industry actors... ´┐Ż Wind Turbine Manufacturing Trends ´┐Ż Supply Chain Key to Delivery |

|

Supply Chain Key to Delivery

Supply chain management is key to wind turbine supply. The relationships between manufacturers and their component suppliers have become increasingly crucial, and have come under increasing stress in the past three years as soaring demand has required faster ramp-up times, larger investments and greater agility to capture value in a rapidly growing sector. Supply chain issues have dictated delivery capabilities, product strategies and pricing for every turbine supplier. Manufacturers have sought to strike the most sustainable, competitive balance between a vertical integration of component supply and full component outsourcing to fit their turbine designs.

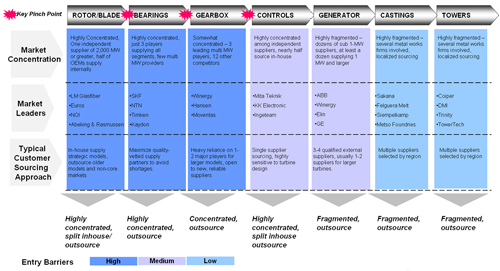

These procurement trends have given rise to unique market structures for each component segment, underlining the complexity of wind turbine design and manufacturing. Figure 3.3 illustrates that multiple segments including blades, bearings, and gearboxes are highly concentrated and produce pinch points in the supply chain. These segments have high entry barriers based on size of investment and manufacturing ramp-up time. At the same time controls, generators, castings, and tower segments have lower entry barriers, with a larger number of players.

It is evident that with such uneven market structures across the supply chain, turbine manufacturers will see an opportunity to vertically integrate in order to reduce risk. In addition, this supply chain structure makes turbine shortages likely, as pinch points ripple through the market due to disparities in the availabilities of the different components. This means that in today’s seller’s market, turbine assembly volume is dictated by the number of units that slip through the tightest pinch point. Generally, a proliferation in suppliers is anticipated throughout the supply chain due to strong growth in the wind industry.

Fig 3.3: Turbine Component Supply Chain Overview Source: Emerging Energy Research. Note: Market leaders refers to regional markets; pinch points reported from turbine component buyers.

| Sitemap | Partners | Disclaimer | Contact | ||

|

coordinated by  |

supported by  |

The sole responsibility for the content of this webpage lies with the authors. It does not necessarily reflect the opinion of the European Communities. The European Commission is not responsible for any use that maybe made of the information contained therein. |