MAIN PUBLICATION :

| Home » ENVIRONMENT » Social acceptance of wind... » Carbon as a commodity |

|

Political national influence on the allocation process and over-allocation of permits

As previously explained, in order to make sure that real trading emerges, Member States must make sure that the total amount of allowances issued to installations is less than the amount that would have been emitted under a business-as-usual scenario.

Under the current system, where a significant degree of freedom over the elaboration of the NAPs is retained by Member States, decisions concerning allocation hinge upon emission projections, national interests and business efforts to increase the number of allowances.

Actual verified emissions in 2005 showed allowances had exceeded emissions by about 80 million tonnes of CO2, equivalent to 4% of the EU's intended maximum level. This happened because Government allocation had been based on over-inflated projections of economic growth and participants had a strong incentive to overestimate their needs.

The publication of those figures provoked the collapse of the CO2 prices to less than €10/ tCO2 in Spring 2006. By the end of 2006 and into early 2007 the price of allowances for the first phase of the EU ETS fell below €1/tCO2 (€0.08/tCO2 in September 2007) (www.pointcarbon.com). The over-allocation of permits and the consequent collapse of CO2 prices have hampered any initiative of clean technology investment, as it is clear that most companies regulated by the EU ETS didn't need to make any significant change to their production processes to meet the target they had been assigned.

Counterproductive allocation methods

The first phase of the EU ETS has shown that free allocation based on absolute historical emissions (grandfathering) causes serious distortions in competition by favouring de facto fossil-fuel generation

A controversial feature of the system has been the ability of the power sector to pass through the marginal cost of freely allocated emissions to the price of electricity and to make substantial profits. This happens because in competitive markets the power generation sector sets prices relative to marginal costs of production. These marginal costs include the opportunity costs of CO2 allowances, even if allowances are received for free. As a consequence, fossil fuels power producers receive a higher price for each kWh they produce, even if the costs for emitting CO2 only apply to a minor part of their merchandise. The effect is known as windfall profit.

In the first phase of the EU ETS, conventional power generators are believed to have made over €12.2 bn windfall profits in the UK. There have been similar arguments over emissions trading scheme windfall profits in other European countries, such as Germany and Spain. Carbon market experts see the situation as likely to arise again in the second trading period. According to a recent Point Carbon study of the UK, Germany, Spain, Italy and Poland, power companies could reap profits in excess of €71 bn over the next four years.

Furthermore, as the economist Neuhoff remarks, any free allocation acts as a subsidy to the most polluting companies which, in addition to not paying the environmental cost they entail, get substantial gains for that. This is clearly in contradiction with the "polluters pay principle" (established by Art. 174 of the EC Treaty), which states "that environmental damage should as a priority be rectified at source and that the polluter should pay".

Grandfathering also penalises "early action" and justifies "non-action". Since allowances are allocated as a function of emission levels, firms are clearly encouraged not to reduce their emissions as this would result in fewer allowances in future phases .

Limited scope of the ETS

About 55% of the CO2 emitted in the EU comes from sectors outside the EU ETS. In the same way, other more powerful greenhouse gases, such as nitrous oxide, sulphurhexaluoride and methane are excluded. The experience from the past years illustrates that it is precisely in some of the sectors that have been left outside the ETS - notably transport - where the highest CO2 emission growth rates have occurred (Eurostat, 2007).

Proposals for the post 2012 period

As a preliminary step to design the third phase of the EU ETS (post 2012), the European Commission has embarked in a public consultation on how the new system should look like. The debate started in November 2006 with the publication of the Communication "Building a global carbon market". In the context of the European Climate Change Programme (ECCP), a Working Group on the review of the EU ETS was also set up to discuss the four categories of issues identified by the EC Communication: scope of the scheme, robust compliance and enforcement, further harmonization and increased predictability, and participation of third countries.

As part of the Commission's climate change and energy package, and in the light of the European Council's 2020 commitments to reduce greenhouse gas emissions by 20% compared to 1990 levels (30% if other developed countries join the effort) a new proposal for reform of the EU ETS Directive was presented on 23 January 2008.

Although the proposal still needs to be approved by both the Council of the EU and the European Parliament, the main elements of the new system, which will enter into force in 2013 and run until 2020, seem to be the following:

- One EU-wide cap on the number of emission allowances. Allowances would be centrally allocated by the European Commission instead of through National Allocation Plans.

- Emissions form EU ETS installations would be capped at 21% below 2005 levels by 2020 - i.e. a maximum of 1,720 million allowances. The annual cap would fall linearly by 1.74% annually as of 2013.

- 100% auctioning for the power sector. For the other sectors covered by the ETS, a transitional system would be put in place, with free allocations being gradually phased out on an annual basis between 2013 and 2020.

- However, an exception could be made for installations in sectors judged to be "at significant risk of carbon leakage", i.e. relocation to third countries with less stringent climate protection laws. Sectors concerned by this measure are yet to be determined.

- At least 20% of auction revenues would have to be ring-fenced to reduce emissions, to support climate adaptation and to fund renewable energy development.

- Extension of the system's scope to new sectors, including aluminium, ammonia and the petrochemicals sectors, as well to two new gases (nitrous oxide and perfluorocarbons). Road transport and shipping would remain excluded, although the latter is likely to be included at a later stage.

- In the absence of an international climate agreement, the limit on the use of the CERs and ERUs is expected to be restricted to the unused portion of operators' phase two caps. This limit is to rise to 50% of the reduction effort if a new international climate agreement is reached.

Carbon as a Commodity

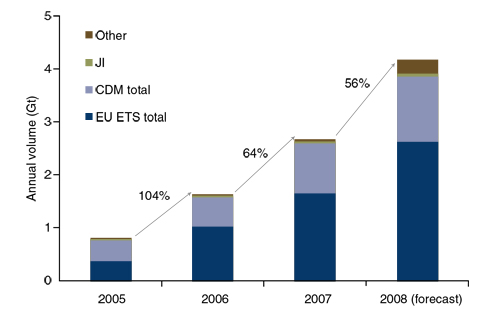

The Kyoto Protocol's efforts to mitigate climate change have resulted in an international carbon market that has grown tremendously since the entry into force of the Protocol in 2005. While previously, the relatively small market consisted mostly of pilot programmes either operated by the private sector or by international financial institutions such as the World Bank, it has experienced strong growth in the past two years, and was valued at €40bn in 2007, 80% more than the 2006 value. The total traded volume increased by 64% from 1.6 MtCO2 in 2006 to 2.7 Mt in 2007.

Figure 3.1: Annual contract volumes 2005-2008, (Point Carbon, 2008)

While the international carbon market has expanded to include a wide variety of project types and market participants, it has been dominated by two types of market-based mechanisms: the EU Emissions Trading System (ETS) and the CDM.

The EU emissions trading scheme continues to be the largest carbon market, with a traded volume of 1.6 MtCO2 and a value of €28bn in 2007, which corresponds to nearly a doubling of both volume and value compared to the previous year. The EU ETS now contains more than 60% of the physical global carbon market and 70% of the financial market. The CDM market increased to 947 MtCO2 equivalents and €12bn in 2007. This is an increase of 68% in volume terms, and a staggering 200% in value terms from 2006, constituting 35% of the physical market and 29% of the financial market. The JI market, while still small, also finally started to take off in 2007, nearly doubling in volume to 38 MtCO2, and more than tripling in value to €326m.

However, experts predict that the potential for future market growth is much larger. Point Carbon forecasts 56% market growth in 2008, increasing volumes to over 4 million tonnes of carbon, with a value of more than €60bn, depending on prices. Current prices in the ETS hover around €25/tonne, and CDM prices range from anywhere between 9 and 17/tonne, depending on the type of project and its stage of development.

Providing that the price for carbon is high enough, the carbon market is a powerful tool for attracting investment, fostering cooperation between countries, companies and individuals and stimulating innovation and carbon abatement world wide. In theory, at least, the price of carbon should more or less directly reflect the rigorousness of the economy-wide caps of the Annex B countries. The reality is of course more complicated, since there is only one real 'compliance market' at present, which is the EU ETS, and the CDM and JI markets are in reality just getting started. It is also not clear what role Canada, Japan and Australia will play in the carbon market during the first commitment period; and of course, the original conception and design of the carbon market was predicated on the fact that the United States would be a large buyer, which has not turned out to be the case, again, for the first commitment period. Governments negotiating the post 2012 climate agreement seem committed to 'building carbon markets' and/or 'keeping the CDM', but there is very little detail to go on at present. The UNFCCC negotiations in June 2008 produced little more than a shopping list of issues to be addressed in the further development of carbon markets in general and the CDM in particular.

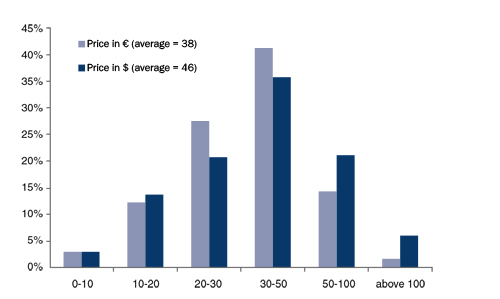

Point Carbon conducted a survey of carbon market practitioners at the end of 2007 and came up with the following, which is as good a prognostication as any as to the future price of carbon.

Figure 3.2: What will be the cost of carbon in 2020? (Currency of choice. N=2591 (2157 responses in EUR; 967 in USD), (Point Carbon, 2008)

Wind energy's contribution to emissions reductions

Emissions from the power sector

The power sector today accounts for 41% of global CO2 emissions (WEO 2006), and continuing improvements in terms of efficiency of thermal power stations are offset by the strong growth in global power demand. The International Energy Agency (IEA) estimates that by 2030, the electricity production will account for over 17,000 MtCO2, up from 10,500 MtCO2 in 2004.

According to the IEA, electricity generation has had an average growth rate of 2.6% since 1995 and is expected to continue growing at a rate of 2.1-3.3% until 2030, which would result in a doubling of global electricity demand. The bulk of this growth is expected to occur in developing Asia, with India and China seeing the fastest growth in demand. World CO2 emissions from power production are projected to increase by about 66% over the period of 2004-2030. China and India alone would account for 60% of this increase.

These figures emphasize the strong responsibility and key role that the power sector has to play in reducing CO2 emissions. According to the IEA, the power sector can be the most important contributor to global emission reductions, with potential CO2 savings of 6-7 Gt by 2050 on the demand side and 14-18 Gt of CO2 reductions on the supply side, if the right policy choices are taken.

The carbon intensity of electricity production largely depends on a given country's generation mix. While inefficient coal steam turbines, which are still in use in many parts of the world, emit over 900 tCO2/GWh or more and oil steam turbines around 800 tCO2/GWh, modern combined cycle gas turbines only produce half as many emissions. China and India, which have a high share of coal in their power mix, see their electricity produced with over 900 tCO2/GWh, while other countries with a high share of renewable energy, such as Brazil, produce power with only 85 tCO2/GWh. The global average for electricity production can be assumed to be at around 600 tCO2/GWh, which is close to the OECD average.

Wind energy's potential for emissions reductions up to 2020

The Intergovernmental Panel on Climate Change (IPCC) released its 4th Assessment Report in 2007, which left no doubt about climate change being real, serious and man-made. It warned that in order to avert the worst consequences of climate change, global emissions must peak and start to decline before the end of 2020. The potential of wind energy to curb global emissions within this timeframe is therefore key to the long-term sustainability of the power sector.

The benefit to be obtained from carbon dioxide reductions through wind energy again mainly depends on which other fuel, or combination of fuels, any increased wind power generation will replace, so this differs from country to country. For the purposes of this paragraph, we therefore assume a global average of 600 tCO2/GWh.

Following the logic of the GWEC Wind Energy Scenarios presented in Part VI, global wind energy capacity could stand at more than 1,000 GW by the end of 2020, producing 2,500,000 TWh annually. As a result, as much as 1,500 MtCO2 could be saved every year.

It is important to point out that modern wind energy technology has an extremely good energy balance. The CO2 emissions related to the manufacture, installation and servicing over the average 20-year lifecycle of a wind turbine are offset after a mere three to six months of operation, resulting in net CO2 savings thereafter.

| Sitemap | Partners | Disclaimer | Contact | ||

|

coordinated by  |

supported by  |

The sole responsibility for the content of this webpage lies with the authors. It does not necessarily reflect the opinion of the European Communities. The European Commission is not responsible for any use that maybe made of the information contained therein. |